Why I’m Long Figma After an 80% Drawdown

Back in 2022, Adobe tried to acquire Figma ($FIG) for $20 billion, but the deal failed due to regulatory scrutiny.

Figma IPO’d on 7/31/25, and since then it has traded down just over 80%.

According to Stock Analysis, Figma has a market cap of $10.92B with an enterprise value of $9.64B.

The company has $1.58 billion in cash and $61.24 million in debt, resulting in a net cash position of approximately $1.52 billion.

Before even getting into the details of the business, it’s worth noting that Figma is currently valued at roughly $9.6B on an enterprise value basis, compared to Adobe’s $20B acquisition offer in 2022.

In other words, the market is valuing Figma at about half of what Adobe was willing to pay just a few years ago, despite a strong balance sheet and a significant net cash position.

That is cheap.

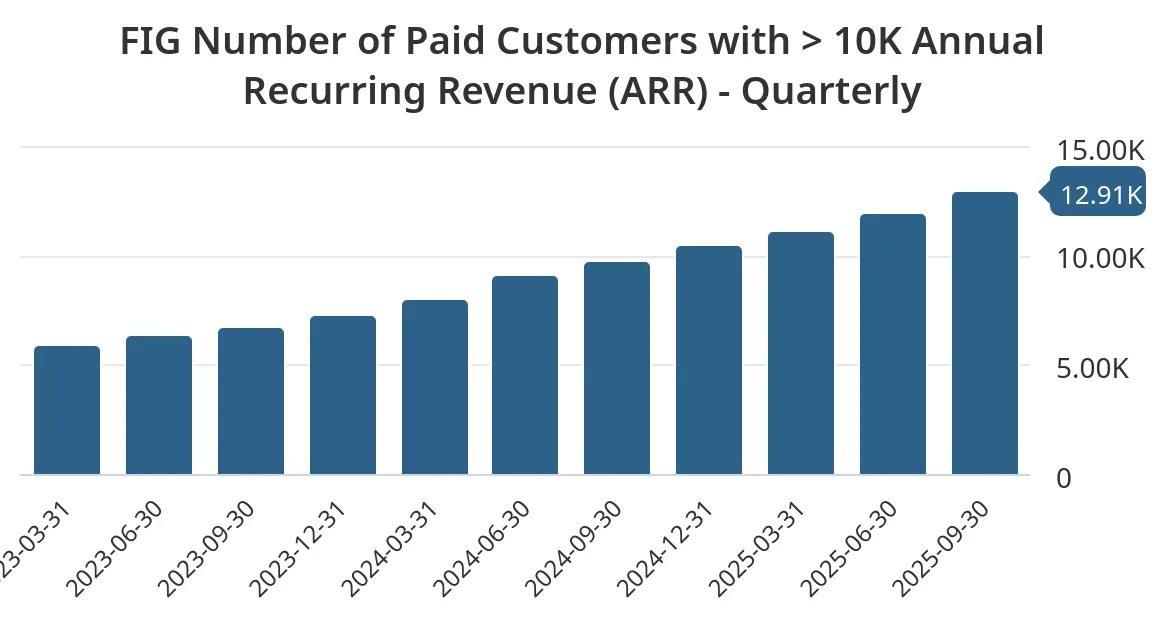

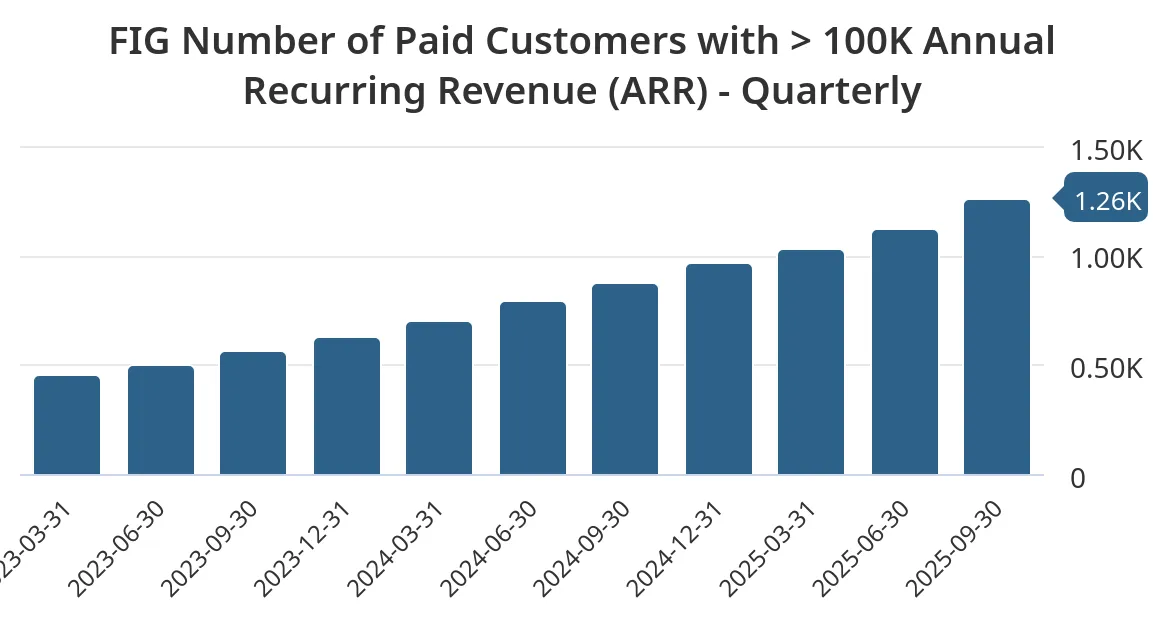

Okay, what else does Figma have going for it? They have a large base of enterprise customers that aren’t going anywhere.

Enterprise customers usually don’t leave.

Figma also has roughly 13 million users across its free and paid plans. That represents a massive distribution asset, with direct access to users through accounts, emails, and ongoing product engagement.

In many cases, companies acquire other businesses largely for their user base. Having the ability to reach and monetize 13 million active users is a meaningful long-term growth lever.

Many people think Figma is going to get crushed because of AI.

But Figma is an AI play.

Chatbots like ChatGPT are already integrating Figma into their services. If you simply go to Figma.com, you can see how deeply AI is integrated into the product, and users are clearly embracing it.

At every company I’ve worked for, front-end designers use Figma. It’s not a question of “what’s next.” It’s the standard.

It’s incredibly sticky for both enterprise customers and SMBs (small and medium-sized businesses).

All of this is why I’m long Figma ($FIG) from 22.22.

I’m hard-stopping the position just below 19.85, and ideally, by February 18th when earnings are set to report, the stock has worked its way up towards 26 so I have a nice cushion to stay long the stock.

My higher time-frame target is a move back toward a $20 billion market cap, which was the original Adobe offer in 2022. That would likely put Figma around $40 per share or slightly higher.

This is not investment advice, and this is just a bigger picture trade I put on. Timing in a market that is no longer going straight up is much more difficult, so keep that in mind...

If you enjoyed this post, feel free to click the toast button below and join the free overnight momentum trading group. We hop on voice chat from 3:40-4:00 pm eastern during the week to discuss potential overnights.